August 2022 Product Release Update – Discover What’s New

We are excited to share the August Product Release Update with you. Find out what’s new and how you will benefit.

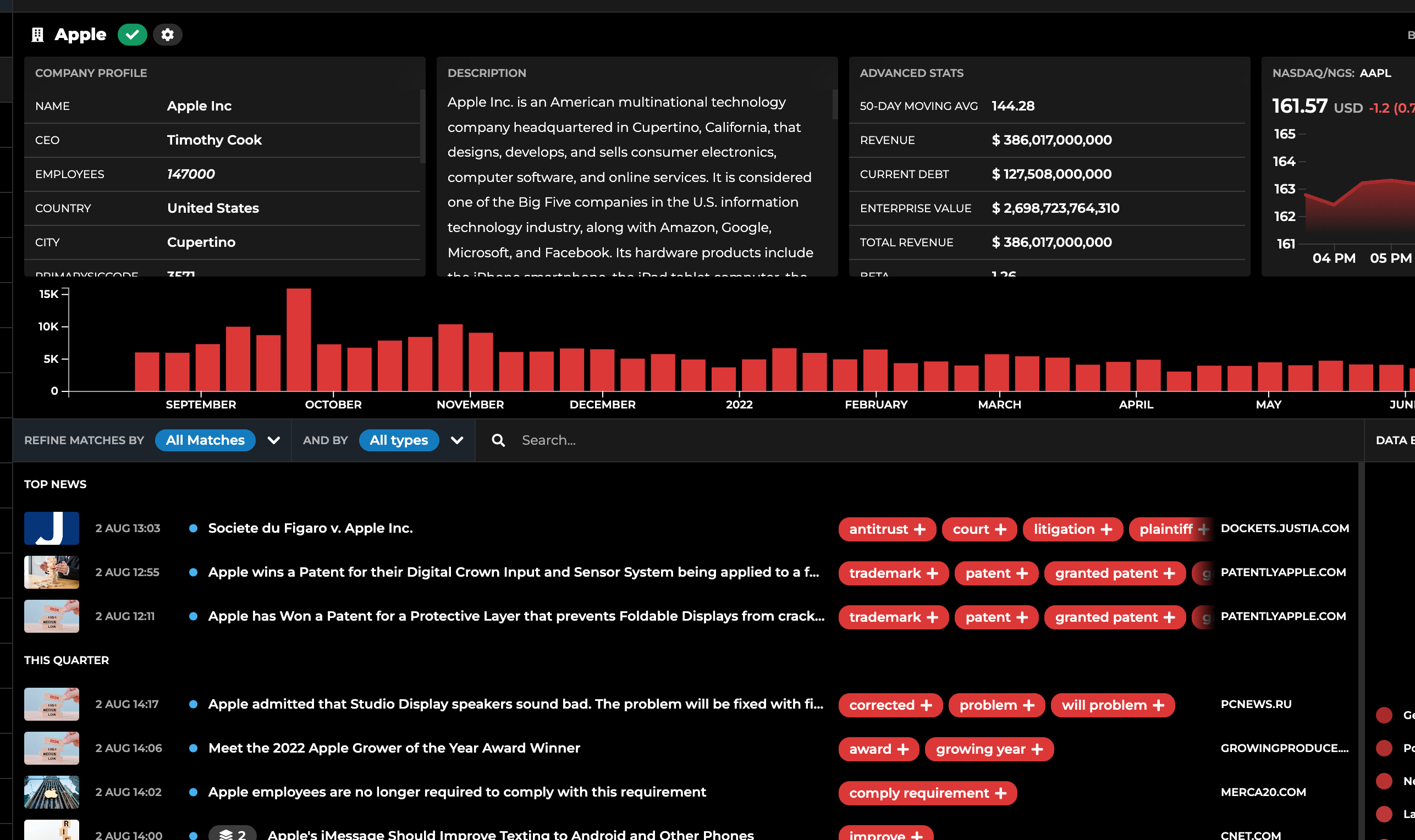

Top News

What’s new?

Our News Feed Tab, the first thing you see after logging in, immediately serves you the current top news related to your entity portfolios. The top news contains the most relevant news stories with respect to the signals in your data views of choice.

By popular demand, we now also offer this functionality for the entity in-depth pages. The update leverages Owlin’s proprietary scoring system to determine which articles from the feed are currently most important with respect to the selected entity and data view.

How you will benefit

As an Owlin user, you can now first conveniently examine the most important news stories before going more in-depth, helping focus on what’s important and save time.

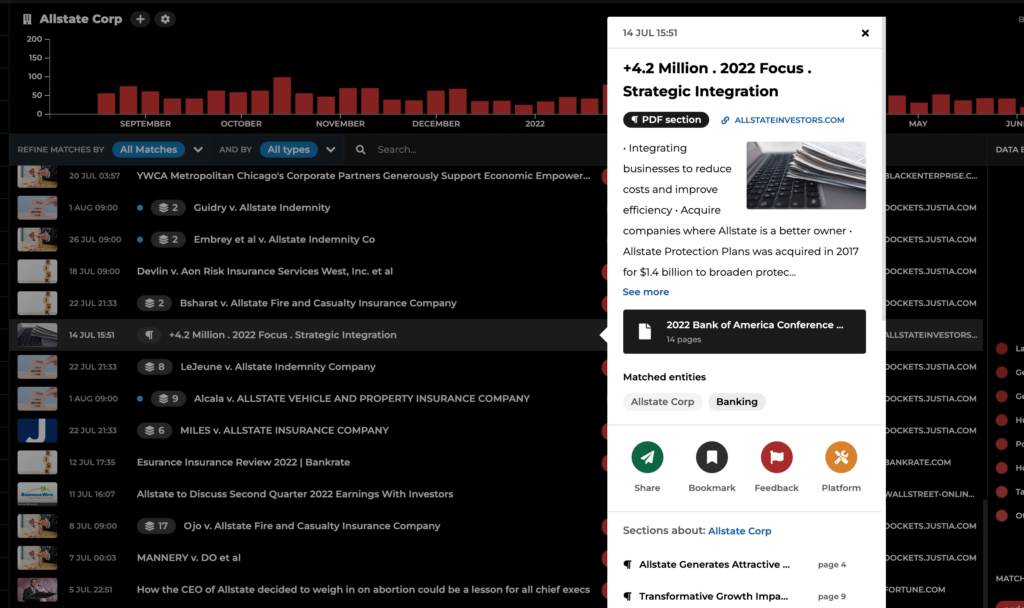

PDF Support

What’s new?

The Owlin platform now also natively supports PDF files! This means we can now collect and parse PDF documents to analyze them for signals relevant to your entity portfolio and data views. From quarterly reports to press releases and internal documents, it’s now possible to integrate their contents and signals they contain into the Owlin Dashboard experience.

We designed a new content popup in which you can see the original PDF, as well as keywords related to the matched signals from our Context Scoring module. You can filter down on the type of document in the entity in-depth pages to identify if there are any PDFs that match on a specific company.

How you will benefit

The PDF integration further enriches Owlin’s proprietary news and data pipeline and helps businesses to develop a truly holistic view.

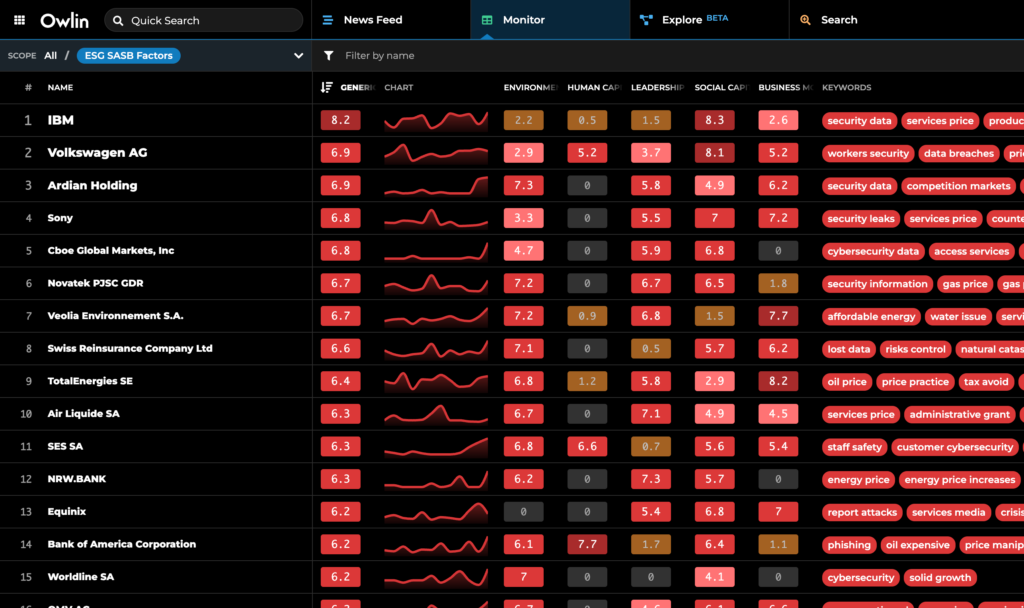

Scores – Data Views

What’s new?

All your portfolio entities receive 0 — 10 scores against the signals configured in your data views. These normalized scores are optimally designed to facilitate ranking & comparing the entities in your portfolios against each other. They take into account historical volumes for both the signals and the entities. This way, smaller companies with trending signals can beat larger companies with large but non-trending signals in the ranking you see in the Monitor Tab. This optimally directs your attention to which signals may need to be acted on. It may not always be what you want, however, so we offer both trending and non-trending variations of the scores.

In the Monitor Tab, we now also offer a numeric score visualization to give users direct access to these scores for sorting & ranking. It makes for very dense and rich data views that show values that are easy to compare and interpret.

How you will benefit

Sorting & ranking your entity portfolios for comparative analysis in the Monitor Tab just has become even more clear and interpretable, helping you navigate more data points and focus your attention on what’s important.

Questions?

Feel free to contact us for more information or instructions on how to use the new features.