Download Our Whitepaper: Consumer Reviews as a Leading Indicator for Merchant Risk

Credit Risk Monitoring

Credit Risk Monitoring Service Provider

In the fast-paced world of finance, credit risk can be a formidable challenge that threatens the financial health and stability of your business. Navigating this intricate landscape of credit risk presents significant challenges, with potential pitfalls at every turn. At Owlin, we understand the complexities that clients face in credit risk monitoring, and we offer cutting-edge solutions to address these very challenges.

Take a Proactive Stance on Credit Risk Monitoring

Effective Credit Risk Monitoring Across Languages:

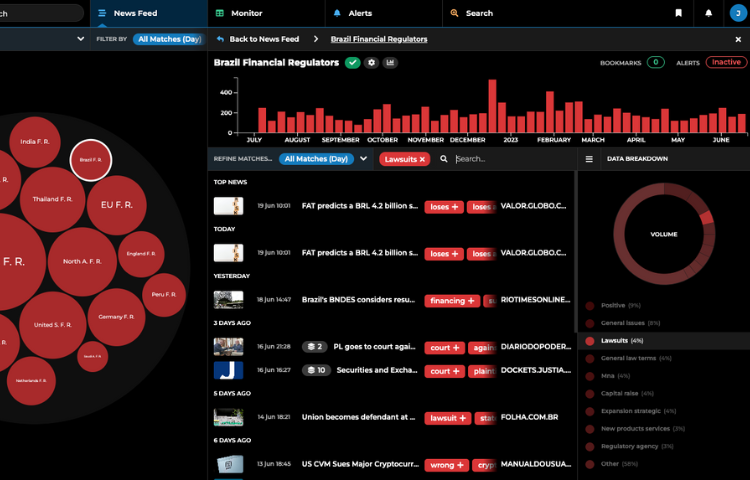

At Owlin, we empower you to navigate an extensive network encompassing over three million sources. We harness advanced capabilities to scrutinize news across a diverse linguistic spectrum. Our state-of-the-art algorithms ensure comprehensive coverage and timely insights from 16 languages, including English, Spanish, Portuguese, Chinese, Russian, French, Dutch, German, Polish, Italian, Danish, Swedish, Arabic, Turkish, Japanese, and Korean.

Personalized Credit Risk Alerts:

Maintain a proactive stance against emerging risks with personalized alerts meticulously crafted for your credit portfolio. Whether they arrive through instant push notifications or a convenient daily/weekly newsletter, you’ll stay promptly informed about risks that matter to your credit risk monitoring. Our tailor-made alerts ensure you are consistently well-informed, enabling you to address concerns and proactively secure your organization.

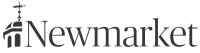

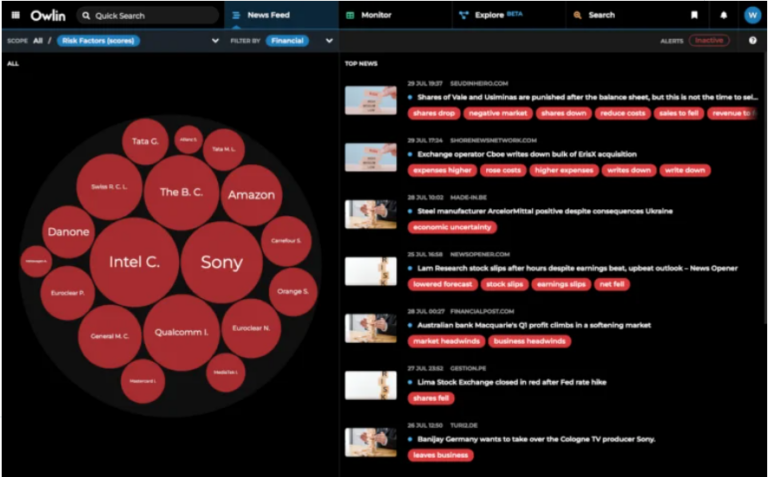

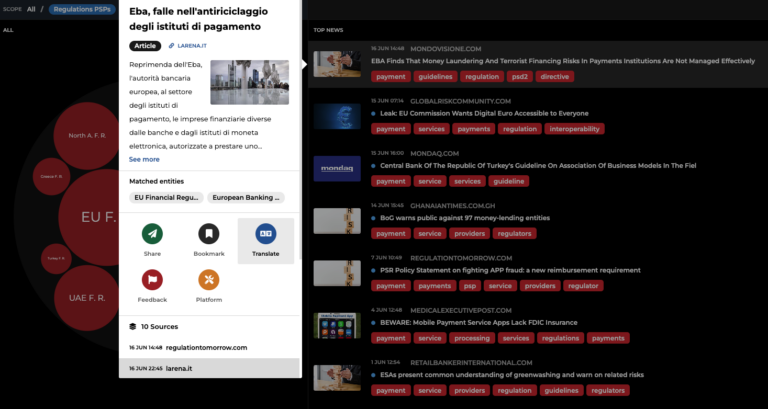

Deeper Insights into Credit News:

Delve deeper into the world of credit news with our expertise. We leverage state-of-the-art Natural Language Processing (NLP) and Entity Recognition techniques to uncover interconnected facts and entities within news reports. Our advanced analysis and clustering methodologies unearth valuable insights, identify correlations, and unveil patterns across the expansive news landscape. These innovative approaches provide you with an in-depth understanding of the relationships and dynamics inherent in credit news, equipping you with the knowledge to make informed credit risk monitoring decisions.

Seamless, Ongoing Credit Risk Monitoring:

For risk teams responsible for overseeing numerous credit relationships, maintaining consistent checks can become an arduous challenge, especially when it entails timely screening of global credit news. Owlin streamlines this process for you. Our advanced solution empowers your organization to analyze extensive global data effortlessly and continuously. This guarantees that you stay at the forefront of credit risk without the need for laborious manual monitoring. Leveraging our tailored filters, which adeptly organize, prioritize, and extract pertinent negative credit news, we ensure your focus remains exclusively on credit risk signals that are relevant to your business.

Frequently Asked Questions about Credit Risk Monitoring

What is Credit Risk Monitoring?

Credit risk monitoring is the practice of assessing and tracking the creditworthiness of individuals, companies, or entities with whom you engage in financial transactions. It’s a crucial aspect of business operations aimed at mitigating financial losses, protecting investments, and maintaining financial stability.

Why Do Companies Prioritize Credit Risk Monitoring?

Companies prioritize credit risk monitoring as a fundamental strategy to safeguard their financial stability and make informed business decisions. Effective credit risk monitoring serves as a proactive approach to mitigate potential financial setbacks and capitalize on opportunities.

What Are the Key Benefits of Credit Risk Monitoring?

Credit risk monitoring offers several key benefits, including:

- Protection Against Losses: Credit risk monitoring helps companies avoid potential financial losses by assessing the creditworthiness of customers, suppliers, and partners.

- Secure Investments: It enables companies to secure their investments by identifying and addressing risky financial relationships early on.

- Improved Financial Planning: Credit risk monitoring provides insights into cash flow and working capital, enhancing financial planning and resource allocation.

- Stronger Supplier Relationships: It helps companies build stronger supplier partnerships, ensuring a consistent supply chain.

- Competitive Advantage: Effective credit risk management provides a competitive edge by attracting reliable customers and securing favorable financing deals.

- Compliance: Many industries have regulations that require credit risk monitoring, ensuring legal compliance and stakeholder trust.

- Identifying Growth Opportunities: Credit risk monitoring identifies creditworthy customers and partners, facilitating sustainable business growth.

Want to see Owlin in action?

Learn more about our solutions and see how we can help your business.

We look forward to meeting you.