Download Our Whitepaper: Consumer Reviews as a Leading Indicator for Merchant Risk

Third-Party Risk Monitoring

Third-Party Risk Monitoring Service Provider

In today’s ever-changing market landscape, characterized by unpredictable dynamics, heightened regulatory scrutiny, and mounting societal pressure, maintaining complete control over risk assessment for vendors, clients, investments, and counterparties has grown increasingly challenging. Adopting a proactive approach to identifying emerging risks has become essential to navigate these complexities successfully.

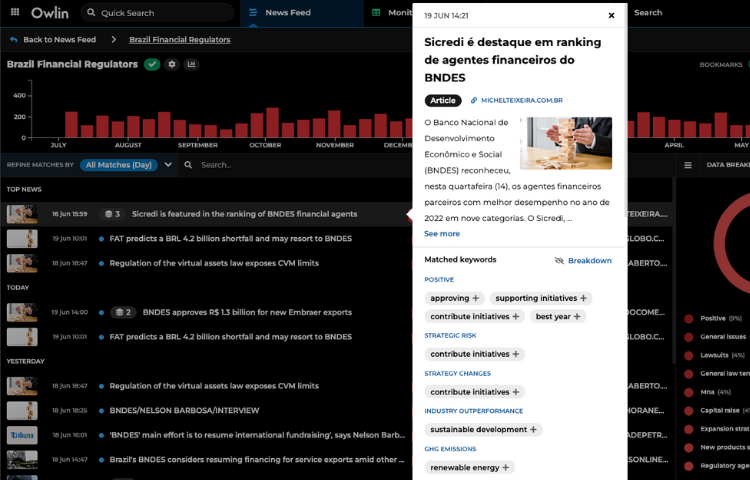

Third-party risk management service provider Owlin helps businesses monitor portfolios for adverse media and integrate risk insights into daily workflows.

How We Help You Detect Risk Signals That Matters Early

Global Coverage of News

Surveil a vast network of more than three million sources, encompassing 17 different languages, and extract essential information about third parties that could potentially pose risks to your organization.

Generate comprehensive insights into your operational landscape, effortlessly transcending geographical and language barriers to ensure thorough risk assessment.

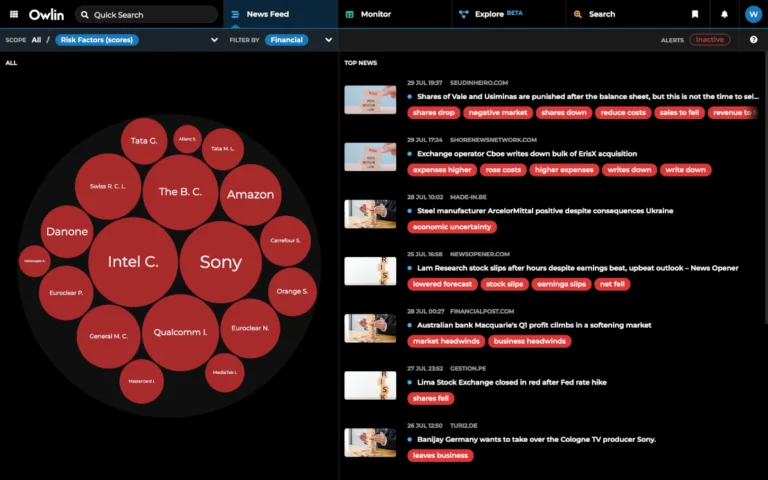

Advanced Risk Ranking

Analyze the performance of your portfolio through dynamic risk ranking. Delve deeper into specific risk factors such as financial, legal, operational risk, or environmental, social, and governance (ESG) factors, enhancing your risk management capabilities like never before.

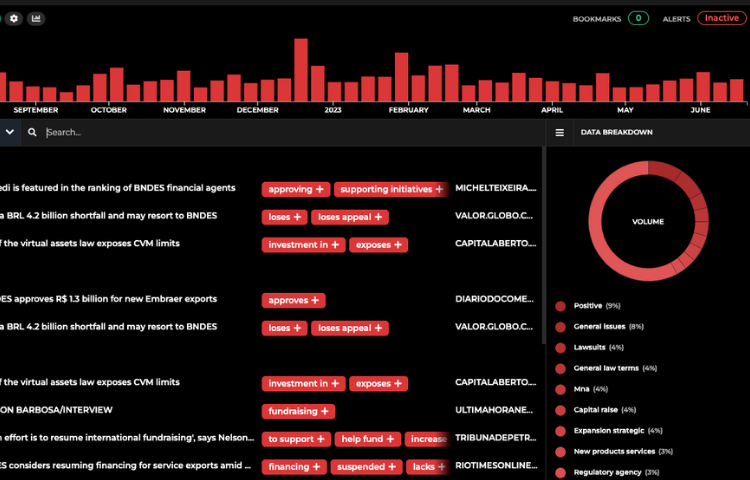

Personalized Alerts

Embrace a new level of risk management efficiency with our cutting-edge solutions. Stay ahead of the curve with personalized alerts for your portfolio, delivered through push notifications or a convenient daily/weekly newsletter, ensuring you are well informed about any emerging third-party risk.

Seamless Integration for Real-Time 360-Degree Insights

Embrace an unparalleled perspective that enables you to make well-informed decisions with confidence. Unify market data, internal research, and relevant alternative data sources seamlessly within the Owlin platform, gaining a comprehensive, real-time 360-degree view.

Frequently Asked Questions About Third-Party Risk Monitoring

What is Third Party Risk Monitoring?

Third-Party Risk Monitoring is the ongoing assessment of third parties a company does business with to measure the risk they pose to the organization. Third-Party Risk Monitoring often forms a part of a company’s Third-Party Risk Management program (TPRM).

What is the difference between Third Party Monitoring and Third Party Risk Screening?

Third-Party Risk Screening refers to the proactive practice of organizations seeking out unfavorable information about companies they intend to collaborate with. This approach helps them identify relevant details that might impact their potential business relationships. Third-Party Monitoring is the practice of ongoing assessment of a third party after they have been onboarded.

Why Do Companies Monitor Third Parties?

By engaging in third-party risk monitoring, risk managers can effectively pinpoint potential risks across diverse areas, including but not limited to cyber security, environmental impact, social responsibility, financial stability, and compliance. This proactive approach empowers them to avoid threats and safeguard their organization’s interests.

How Can Organizations Leverage News Sources to Monitor For Third-Party Risk?

When organizations monitor third parties by monitoring the news, we call this adverse media monitoring. There are several diverse approaches organizations can adopt to monitor for adverse media. A standard method involves dedicating resources to manual risk assessments and meticulously reviewing news sources and other relevant information to identify adverse incidents related to vendors.

However, tackling the complexity of monitoring numerous vendors can be overwhelming for human operators, especially when it involves rapidly screening vast global news sources in multiple languages. Organizations can leverage technologies like Artificial Intelligence (AI) and Natural Language Processing (NLP) to automate the process to conquer this challenge, unveiling crucial insights that may have otherwise eluded detection. The automatization of monitoring practices allows companies to expand their third-party landscape monitoring to an unprecedented scale, guaranteeing comprehensive attention and scrutiny for all third parties in their ecosystem.

How Can Technology Help Businesses Monitor for Third-Party Risk?

Organizations can capitalize on technological advancements that enable the analysis of massive amounts of global data, allowing organizations to proactively identify and address potential risks in almost real-time.

What Types of Risk Signals Do Companies Look For When Monitoring the News For Third-Party Risk?

The definition of adverse media varies depending on the organization conducting the screening and the potential impact of threats on their operations. However, several risk signals are commonly considered when monitoring the news to monitor for third-party risk:

News Indicating Operational Risk

This involves the risk of disruptions or inefficiencies in operations caused by actions or shortcomings of third-party vendors or service providers. For instance, news reporting a significant data breach or cyber-attack that compromises a company’s systems and disrupts operations indicates operational risk.

News Indicating Compliance Risk

This pertains to the risk of non-compliance with laws, regulations, or industry standards due to the actions or practices of third-party entities. Allegations of regulatory violations or non-compliance with industry standards signify compliance risk.

News Indicating Reputational Risk

This relates to the risk of damage to an organization’s reputation due to adverse events associated with third parties. For example, news about a major data breach compromising customer information and privacy indicates reputational risk.

News Indicating Information Security Risk

This includes the risk of data breaches, unauthorized access, or loss of sensitive information due to inadequate security measures or vulnerabilities in third-party systems or processes. News reporting a successful cyber-attack resulting in a data breach signifies information security risk.

News Indicating Financial Risk

This involves the risk of financial losses, fraud, or improper financial practices resulting from third-party entities’ actions or economic instability. News articles reporting a significant decline in a company’s financial performance, such as a sharp drop in revenue or profits, indicate financial risk.

News Indicating Supply Chain Risk

Supply Chain Risk encompasses risks associated with the supply chain, such as disruptions, quality issues, non-compliance, or unethical practices from third-party suppliers or logistics partners. News reporting a supply chain disruption due to natural disasters, political instability, or a major supplier’s financial difficulties signifies supply chain risk.

News Indicating Legal Risk

This refers to the risk of legal disputes, litigation, or regulatory actions arising from third-party entities’ activities, contracts, or non-compliance. News articles reporting lawsuits or regulatory investigations involving a company indicate legal risk. Attention to these risk signals in the news can help organizations proactively address potential threats and safeguard their interests.

What Sources Can be Used to Monitor for Third-Party Risk?

In addition to news articles, organizations can harness various other databases for comprehensive adverse media monitoring, aiming to detect risk signals early. These sources include Chamber of Commerce Data, Sanctions Data, Politically Exposed Persons (PEP) Data, State-Owned Enterprises (SOE) Data, Black- and Warning lists, Consumer Reviews, PDF documents, and Alternative Data (such as financial statements). By utilizing this broad array of sources, businesses can bolster their risk detection capabilities and stay vigilant in safeguarding their interests.

Want to see Owlin in action?

Learn more about our solutions and see how we can help your business.

We look forward to meeting you.