Download Our Whitepaper: Consumer Reviews as a Leading Indicator for Merchant Risk

Merchant Risk Management

Merchant Risk Management Solution

In the dynamic world of Payment Service Providers (PSPs), timely responses to emerging risks can be challenging, particularly when dealing with global merchant portfolios with substantial exposures. Fortunately, adverse media monitoring allows PSPs to optimize their merchant risk management by proactively identifying potential risks and protecting their businesses.

Learn more about our Merchant Monitoring Solution that PSPs like Adyen, Nuvei, and Worldline leverage to monitor their extensive merchant portfolios across diverse languages and geographies. Discover how Owlin can help you minimize chargeback risk and optimize capital efficiency.

Owlin for Merchant Risk Management

Receive Early Alerts that Indicate Potential Merchant Risk

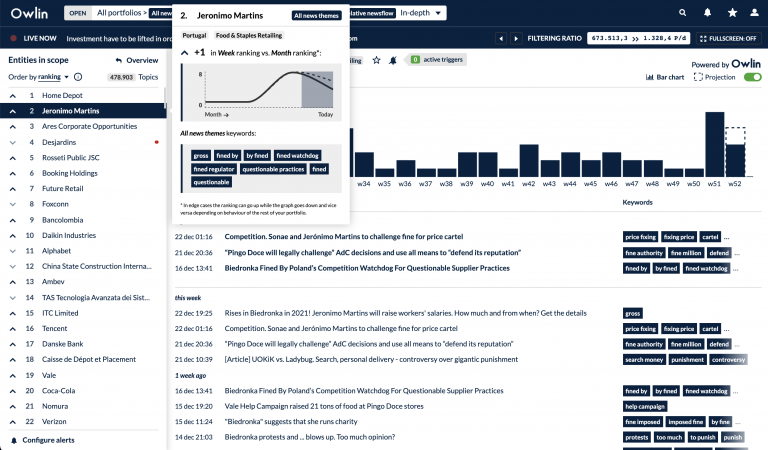

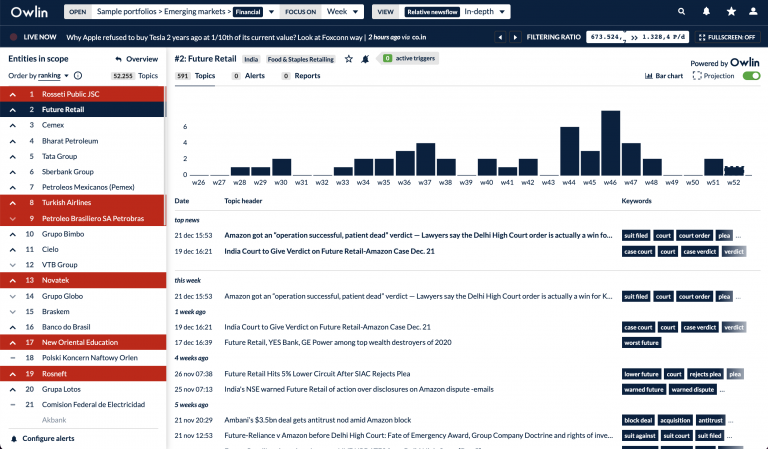

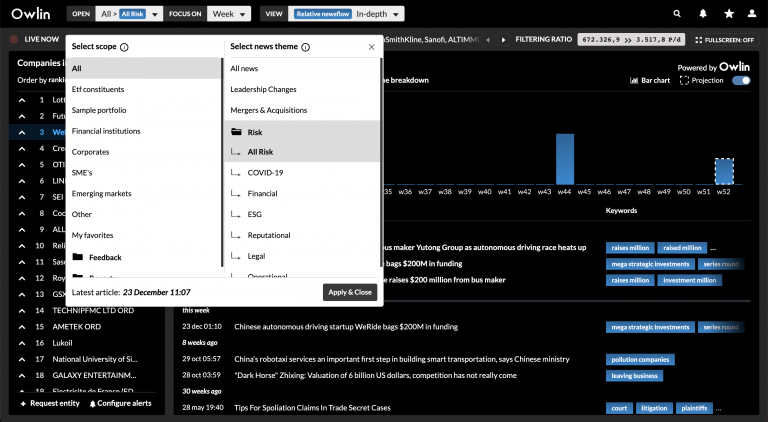

Owlin’s solution for Merchant Monitoring is designed to provide an efficient workflow that delivers early warning signals for a comprehensive range of risks spanning financial and non-financial domains. Stay ahead of the game with timely alerts on bankruptcy signals, fraudulent activities, and operational issues, empowering you to take proactive action and safeguard your business effectively.

Extensive coverage

From prominent e-commerce giants to mid-market firms in emerging markets, Owlin’s versatile news and language monitoring service, ensures that no critical signals slips through the cracks. Stay informed and make well-informed decisions with Owlin’s comprehensive coverage tailored to your needs.

Responsible & Compliant

Owlin’s offerings have been honed through collaborations with industry pioneers and are designed to bolster credit, compliance, and operational risk frameworks. Rest easy knowing that Owlin empowers PSPs to navigate regulatory requirements easily and efficiently, ensuring a seamless and compliant business environment.

Frequently Asked Questions About Merchant Risk Management

What Drives PSPs to Choose Owlin for Their Merchant Monitoring Needs?

There are two primary reasons behind this decision. Firstly, PSPs must adhere to anti-money laundering and counter-terrorist financing (AML/CFT) regulations. Beyond preventing fraud, they must conduct comprehensive monitoring to assess, detect, and prevent payment-related risks. This includes transaction and risk monitoring to ensure compliance with relevant regulations and to safeguard the PSP from undue risks.

Secondly, monitoring merchants is essential for PSPs to mitigate risks associated with their merchant portfolio. During the underwriting process, PSPs assume liability and guarantee payment in case of fraud. Additionally, they are responsible for refunding customers with outstanding orders if a merchant faces financial distress or goes bankrupt. Hence, monitoring merchants for potential red flags and financial distress indicators is crucial to prevent defaults and protect the PSP.

Owlin’s capabilities extend beyond traditional news data sources, as it can detect leading risk signals from alternative sources like consumer reviews, allowing PSPs to de-risk before adverse events occur.

What Are Challenges PSPs Face When Monitoring Merchants?

PSPs encounter a range of challenges when undertaking the task of monitoring merchants. The complexity arises from managing vast and diverse portfolios, which often makes it challenging to identify potential indicators of financial distress or fraudulent activities. Moreover, obtaining all necessary information about merchants, such as bankruptcy records or other red flags, can prove arduous for PSPs. This difficulty is further amplified when dealing with data in foreign languages.

Adding to the complexity, much of the critical information needed for monitoring may not be readily accessible, necessitating labor-intensive efforts to retrieve data from non-standard media sources. Despite these obstacles, effective merchant monitoring remains integral to the PSPs’ due diligence process, ensuring a robust merchant risk management approach.

How Can Payment Service Providers Utilize Adverse Media for Monitoring Their Merchants?

PSPs can effectively utilize adverse media signals to monitor their merchants’ performance closely. These signals encompass various indicators, such as financial distress, regulatory investigations, layoffs, or downsizing. By keenly observing these signals, PSPs can promptly identify potential issues that may arise with a merchant.

Staying vigilant about adverse media signals allows PSPs to safeguard themselves from unnecessary risks and take proactive measures to protect their interests. Utilizing adverse media as a monitoring tool empowers PSPs to make informed decisions and uphold the integrity of their payment services.

How Does Owlin Assist Payment Service Providers With Monitoring Adverse Media?

With access to a vast database of over 3 million sources in 17 languages, Owlin’s platform utilizes cutting-edge AI (NLP) technology to present relevant signals through graphs and alerts. Owlin’s advanced algorithms ensure PSPs stay informed about even the most niche topics in near real-time, allowing merchant risk managers to concentrate on critical matters efficiently.

Want to see Owlin in action?

Learn more about our solutions and see how we can help your business.

We look forward to meeting you.