Download Our Whitepaper: Consumer Reviews as a Leading Indicator for Merchant Risk

Consumer Review Monitoring

Consumer Review Monitoring for PSPs

Are consumers dissatisfied with products, complaining about order fulfillment delays or disputed transactions? For Payment Service Providers (PSPs), analyzing alternative data like consumer reviews is a way to detect leading risk indicators that something may be amiss with a merchant.

Find out how our platform allows PSPs to monitor consumer review data continuously, across borders and languages, and in real-time.

How Owlin Helps PSPs Monitor Consumer Reviews

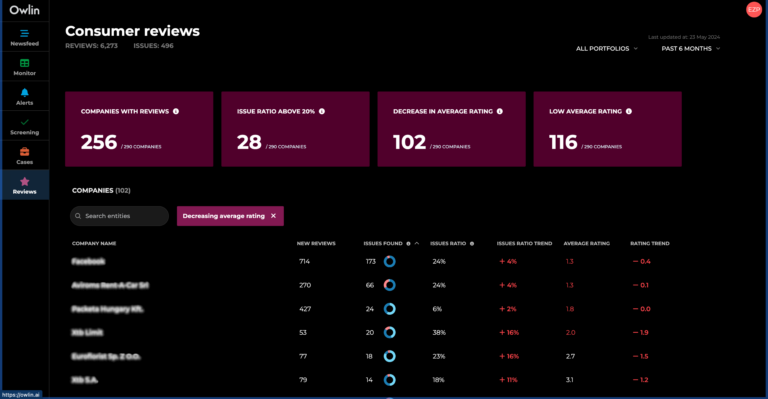

Effectively Monitor and Analyze Consumer Reviews of Extensive Portfolios

Using Owlin, Payment Service Providers can continuously monitor and analyze consumer reviews for all their merchants, ensuring comprehensive oversight. PSPs can choose their preferred topic they want to monitor, aligning with their type of merchant when negative trends are identified for a specific topic or overall.

Analyze Consumer Reviews in Multiple Languages

Owlin’s advanced algorithms enable PSPs to analyze consumer reviews in 17 languages, ensuring a comprehensive understanding of consumer sentiment and feedback. PSPs can effectively monitor consumer reviews in English, Spanish, Portuguese, Chinese, Russian, French, Dutch, German, Polish, Italian, Danish, Swedish, Arabic, Turkish, Japanese, and Korean. This capability provides PSPs with near real-time insights across diverse linguistic landscapes, facilitating a globally inclusive monitoring approach.

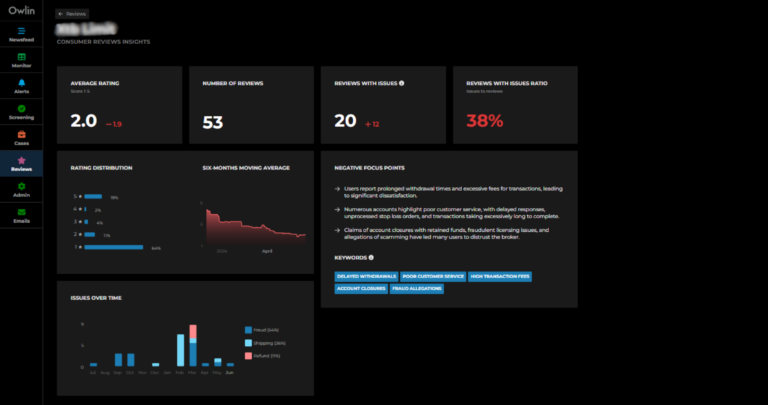

Gain Insights From Easily Interpretable Graphs Depicting Historical Review Trends

Understanding the significance of a single negative review in isolation can be challenging. However, Owlin provides customers with a customizable dashboard that facilitates straightforward interpretation and analysis, as well as the ability to set risk tolerance levels with respect to which type of news or events they wish to be notified of. Our Consumer Reviews module equips PSPs with informative graphs that depict historical review trends, providing a clearer picture. By observing sudden shifts in trends, PSPs can detect anomalies or potential issues associated with a merchant, allowing for timely intervention.

Frequently Asked Questions About Consumer Review Monitoring

Why do PSPs monitor consumer reviews?

For PSPs it is critical to maintain oversight of their merchant portfolio, because they assume the role of underwriters. Therefore, they must undertake stringent risk management measures to mitigate the risk of financial losses.

What challenges do Payment Service Providers face when monitoring merchants?

The complex task of manually monitoring consumer reviews of large portfolios of merchants poses significant challenges for PSPs, particularly when it requires real-time monitoring of consumer review platforms worldwide. More often than not, consumer reviews are checked by a PSP’s risk management team on a reactive rather than proactive basis, given the manual effort involved. Other challenges they encounter are evaluating consumer reviews in different languages and identifying historical patterns.

How can technology help PSPs to monitor consumer reviews?

To monitor consumer reviews, PSPs can leverage technological advancements to capitalize on AI-based tools, specifically those powered by Natural Language Processing (NLP). These tools enable PSPs to efficiently analyze extensive volumes of historical up to current-day consumer review data, empowering them to promptly detect and address potential risks, regardless of the size or geographical location of the merchant.

Leveraging these technologies allows risk teams to expand their monitoring reach to encompass a larger universe of merchants, ensuring that adverse media and consumer reviews for every merchant in their merchant portfolio are being monitored in real-time. Also, technology can help them prioritize high-risk merchants needing extra attention and further investigation.

How does Owlin’s Consumer Review Monitoring module enhance KYC frameworks and facilitate future reviews or investigations for PSPs?

Owlin’s Consumer Review Monitoring module is part of Owlin’s KYC for PSPs offering. This end-to-end KYC solution offers PSPs streamlined onboarding, continuous monitoring, audit trails, and effortless offboarding, not only enhancing KYC frameworks for regulatory requirements but also facilitating future reviews or investigations.

During the onboarding process, Owlin for KYC conducts thorough screenings against multiple databases. Owlin’s continuous monitoring capabilities give PSPs real-time insights into entities and help to easily prioritize entities and topics/risks that require immediate attention. When it comes to offboarding, Owlin for KYC simplifies this process and ensures that all relevant case information is retained.

Want to see Owlin in action?

Learn more about our solutions and see how we can help your business.

We look forward to meeting you.