Chargeback Risk Monitoring

Chargeback Risk Monitoring Service Provider

In the competitive landscape of financial transactions, chargeback risks can pose significant challenges that might impact the financial stability and sustainability of your business. Navigating the complex world of chargeback risks necessitates constant vigilance and proactive mitigation strategies. Owlin comprehends the complexities faced by businesses in chargeback risk management, and we offer cutting-edge solutions tailored to address these precise challenges.

Take a Proactive Approach to Chargeback Risk Identification and Mitigation

Efficiently Monitor Chargeback Risks Across Various Parameters:

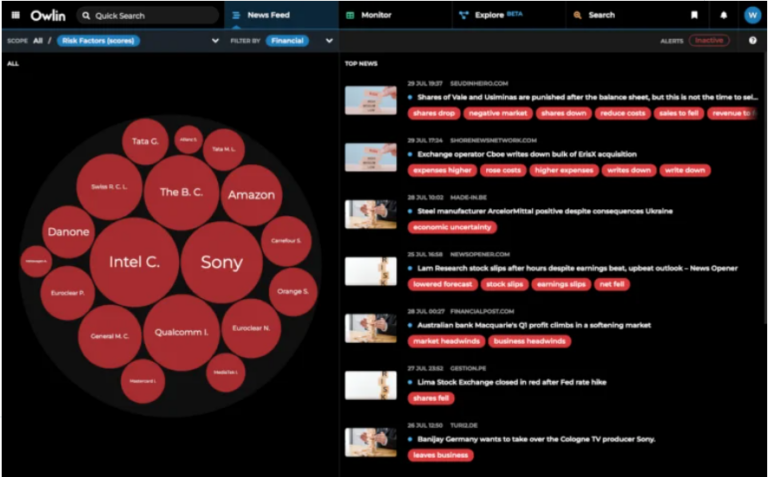

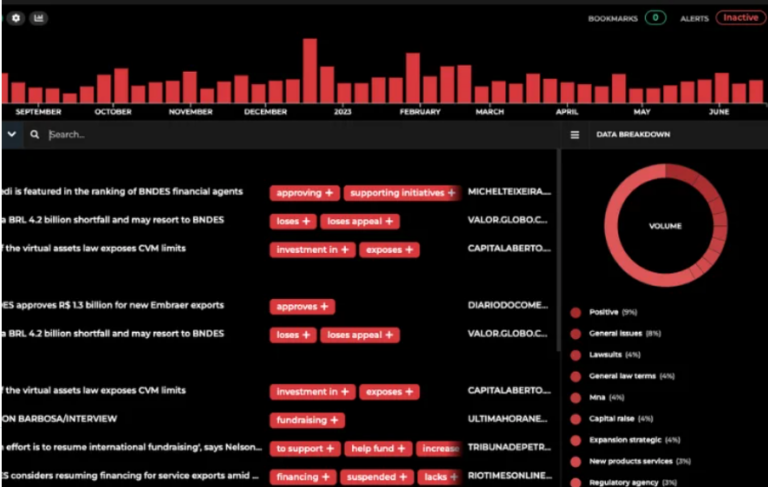

With Owlin, you gain the capability to oversee a wide network spanning over three million sources, leveraging our advanced capabilities to scrutinize news and data across an extensive landscape. Our state-of-the-art algorithms offer comprehensive coverage and timely insights, enabling you to effectively monitor chargeback risks and their associated implications on your business.

Tailored Chargeback Risk Notifications:

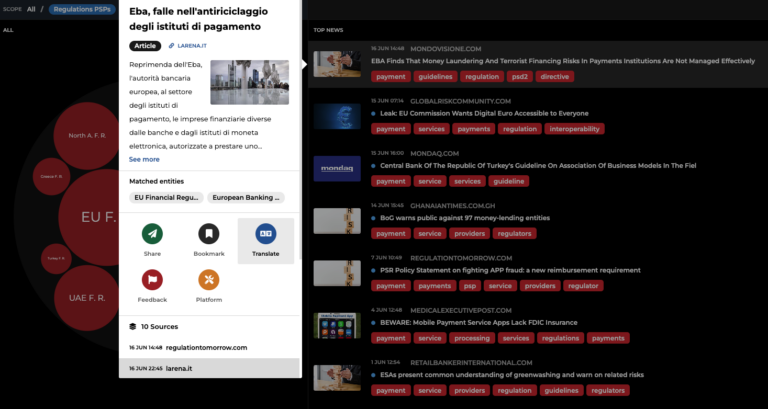

Stay one step ahead of emerging chargeback risks with Owlin’s personalized alerts meticulously designed for your specific business needs. Whether they arrive through instant push notifications or a convenient daily/weekly newsletter, you’ll receive prompt updates regarding potential threats relevant to your chargeback risk monitoring. Our customized alerts ensure you are consistently well-informed, empowering you to promptly address chargeback risk concerns and proactively secure your organization.

Gain Deeper Insights into Chargeback News:

Leveraging cutting-edge Natural Language Processing (NLP) and Entity Recognition techniques, we delve into news reports to uncover interconnected facts and entities related to chargeback risks. Our advanced analysis and clustering methods extract valuable insights, identify correlations, and unveil patterns within the extensive news landscape. These approaches provide you with a profound understanding of the relationships and dynamics inherent in chargeback news, enabling you to make more informed decisions.

Continuous Chargeback Risk Monitoring:

For risk management teams handling numerous financial transactions, monitoring chargeback risks can become a daunting task, especially when it involves the timely screening of global news and financial data. Owlin streamlines this process for you. With our advanced solution, your organization can effortlessly analyze vast amounts of global data continuously. This ensures that you stay on top of chargeback risks without the burden of manual monitoring. Our tailored filters enable you to focus solely on chargeback risk signals that are relevant to your business.

Frequently Asked Questions about Chargeback Risk Monitoring

What is Chargeback Risk Monitoring?

Chargeback risk monitoring is a proactive approach used by businesses to detect and prevent potential chargebacks before they occur. It involves the continuous monitoring of transactions, customer behavior, and other relevant data points to identify any patterns or activities that might indicate a potential chargeback. By leveraging advanced analytics and machine learning, businesses can assess the risk associated with each transaction and take appropriate measures to minimize the occurrence of chargebacks.

Why Do Organizations Prioritize Chargeback Risk Monitoring?

Businesses prioritize chargeback risk monitoring to safeguard their financial health and reputation. Chargebacks can result in significant financial losses and damage a company’s credibility, leading to increased processing fees, lost revenue, and potential penalties from payment processors. By prioritizing chargeback risk monitoring, businesses can mitigate the negative impact of chargebacks, enhance customer trust, and maintain a secure and sustainable payment ecosystem.

How Does Owlin’s Chargeback Risk Monitoring Solution Work?

Owlin’s Chargeback Risk Monitoring Solution employs a sophisticated combination of real-time data analysis, predictive modeling, and comprehensive risk assessment techniques. It continuously analyzes transactional data, customer behavior, and industry trends to identify potential chargeback risks. Through advanced algorithms and customizable risk thresholds, Owlin’s solution provides businesses with actionable insights and timely alerts, enabling them to proactively address potential chargebacks and reduce financial vulnerabilities effectively.

Want to see Owlin in action?

Learn more about our solutions and see how we can help your business.

We look forward to meeting you.