Owlin for Banks

Experience the power of Owlin for Banks, a comprehensive solution for Third-Party Validation and Due Diligence specifically designed for banks:

- Comprehensive screening and automated monitoring

- Access to 3 million sources and 17 languages

- Extensive Data Coverage, including PEPs, Sanctions Data, Consumer reviews, CFPBs complaints, and K8/K10 documents

- Historical adverse media data: retrieve articles going back 7 years

Want to know how Owlin for Banks adds value to your organization?

Why do Banks Leverage Owlin?

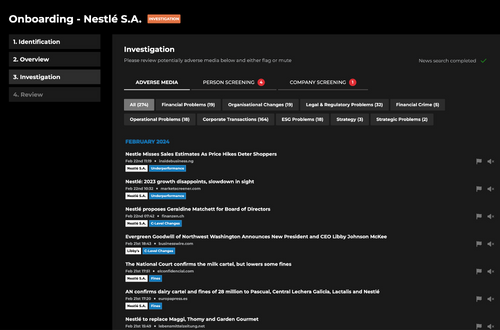

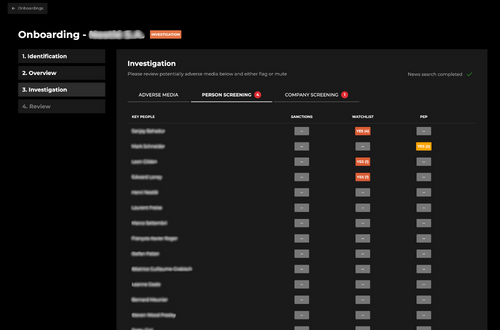

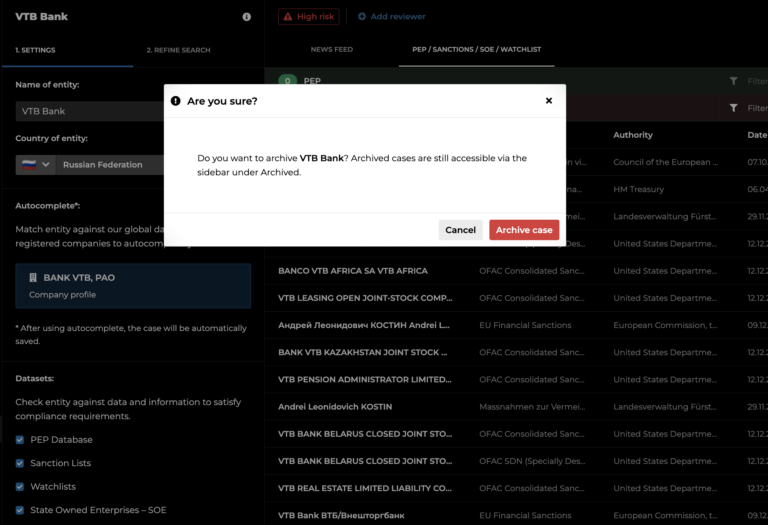

Comprehensive Screening and Automated Monitoring

Check third parties against all relevant databases simultaneously and monitor third parties post onboarding approval by saving queries and issuing alerts for pertinent risk indicators.

Access to 3 Million Sources and 17 Languages

Owlin’s advanced algorithms continuously scan over 3 million mainstream and niche sources across 17 languages in almost real time. To meet the needs of banking clients, Owlin includes data covering Adverse Media, Sanctions, Politically Exposed Persons (PEP), State-owned Enterprises (SOE), various Watchlists & Blacklists, U.S. Securities and Exchange Commission (SEC) filings, and the Consumer Complaint Database of the U.S. Consumer Financial Protection Bureau (CFPB).

Harnessing the power of AI, Owlin highlights pertinent signals through graphs and alerts, translating into unparalleled speed to insights and time savings.

Historical Adverse Media Data

With Owlin for Banks, users can retrieve articles going back seven years. If the article is deleted, we have it!

Frequently Asked Questions about Owlin for Banks

Can Owlin for Banks be integrated into existing workflows?

Owlin for Banks sets itself apart with its seamless integration capabilities with existing tools and systems banks utilize. Recognizing that many users already have numerous tools to perform their tasks, Owlin for Banks seamlessly integrates with these systems, ensuring a smooth transition and enhancing user experience.

How does Owlin conduct adverse media monitoring?

Our advanced algorithms continuously scan over 3 million mainstream and niche sources across 17 languages in almost real time. Harnessing the power of AI, specifically Natural Language Processing (NLP), we present pertinent signals through graphs and alerts, enabling you to focus on critical information. For further insights into Owlin’s Adverse Media capabilities, check out our blog post titled ‘Adverse Media Check: Why a Google Search Isn’t Enough‘.

Can I integrate my data into the Owlin database?

Owlin offers a rich API suite that allows you to load your data into our platform securely and scalable. This will enable you to enrich the company profiles that are of interest to you.

Is collaborative work possible within Owlin for banks?

Absolutely! Collaborate effectively by annotating and sharing onboarding cases with team members. Additionally, user-created queries can be saved and transferred or assigned to colleagues, promoting efficient teamwork.

Does Owlin for banks provide audit trails?

Indeed! Owlin for Banks enables the swift generation of audit trails for each onboarding case and monitoring alert response, ensuring transparency and compliance.

Want to see Owlin in action?

Learn more about our solutions and see how we can help your business.

We look forward to meeting you.