Revolutionizing Risk Management: Consumer Review Monitoring for PSPs

Are consumers dissatisfied with products, complaining about order fulfillment delays or disputed transactions? For Payment Service Providers (PSPs), analyzing alternative data like consumer reviews is a way to detect leading risk indicators that something may be amiss with a merchant.

Moreover, an increase in negative consumer reviews often indicates that something may be going on before negative events are reported in traditional news sources or financial reports. Because it is critical that PSPs maintain oversight of their merchant portfolio since they assume the role of underwriters, they must undertake stringent risk management measures to mitigate the risk of financial losses.

In this blog, we dive deeper into how PSPs can leverage technology to overcome the challenges they face when monitoring consumer reviews. We also explore how Owlin’s solutions allow PSPs to monitor consumer review data continuously, across borders and languages, and in real time.

The Value of Consumer Review Monitoring: A Case Study

In March 2021, news came out about a Leeds-based electrical appliances business, Power Direct. The news article1 reported that the company was facing accusations of fraud and “ripoffs” as hundreds of customers across the UK complained about not receiving the goods they paid for. Also, customers had been unable to reach the company for responses, and the website was no longer accessible. The company, which claimed to offer big brands at low prices, had received over 500 official complaints by March 2021 and had a one-star rating from almost half of its Trustpilot reviews.

Looking back, it has been observed that the number of negative reviews for Power Direct began to increase in early 2020, indicating a growing dissatisfaction among its consumers. The average review rating of the company also started declining during the same period. News regarding these complaints and accusations against Power Direct were only reported publicly in March 2021, by which time it was too late for PSPs to de-risk and minimize potential losses related to this merchant.

Challenges Risk Teams Face When Monitoring Consumer Reviews

The complex task of manually monitoring consumer reviews of large portfolios of merchants poses significant challenges for PSPs, particularly when it requires real time monitoring of consumer review platforms worldwide. More often than not, consumer reviews are checked by a PSP’s risk management team on a reactive rather than proactive basis, given the manual effort involved. Other challenges they encounter are evaluating consumer reviews in different languages and identifying historical patterns (figure 1).

Figure 1

Leveraging AI-Based Tools for Efficient Consumer Review Monitoring

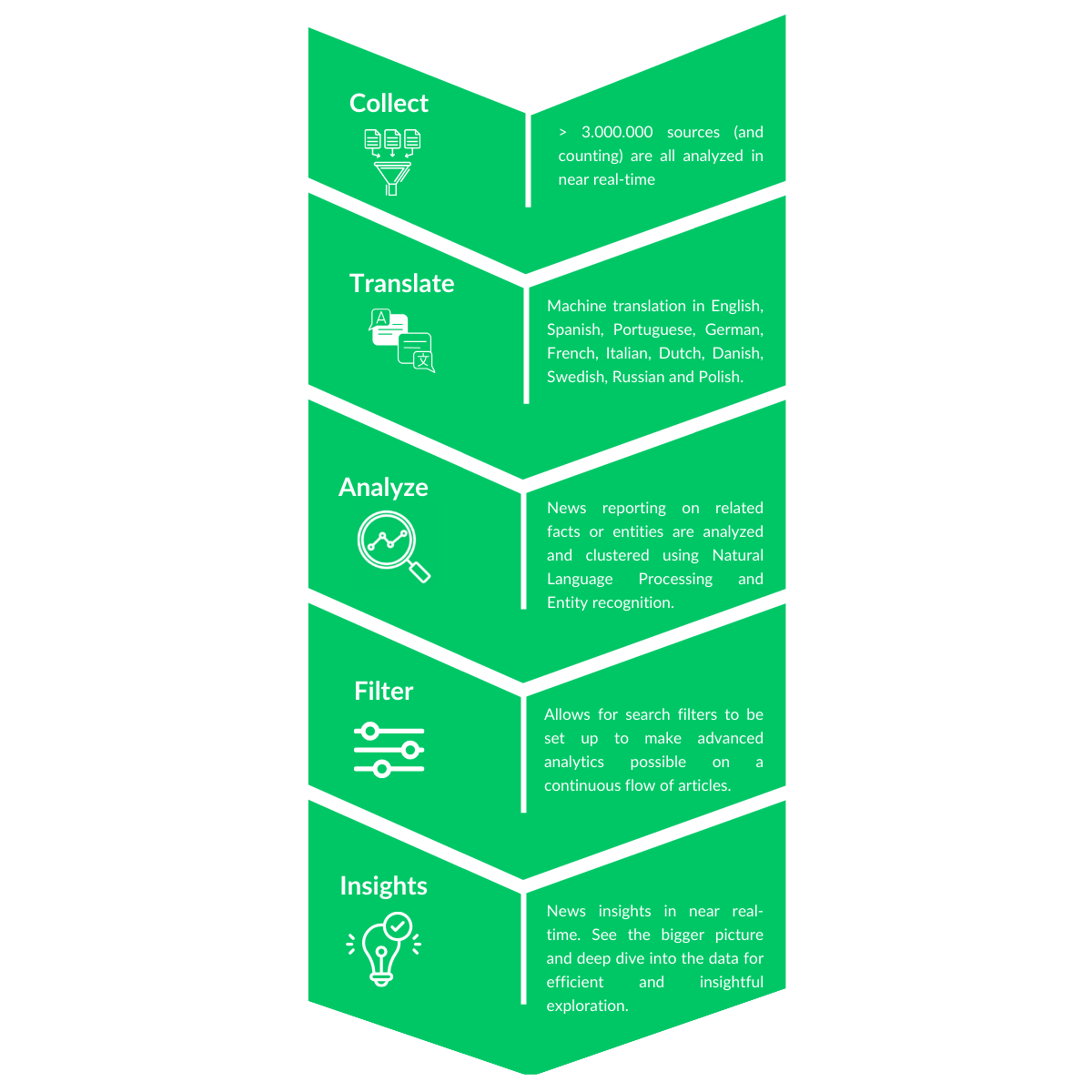

To monitor consumer reviews, PSPs can leverage technological advancements to capitalize on AI-based tools, specifically those powered by Natural Language Processing (NLP). These tools enable PSPs to efficiently analyze extensive volumes of historical up to current-day consumer review data, empowering them to promptly detect and address potential risks, regardless of the size or geographical location of the merchant (figure 2).

Figure 2

How Owlin Can Help PSPs Monitor Consumer Reviews

By harnessing the power of advanced technologies such as AI (NLP) and LLMs (Large Language Models), the Owlin platform is the market-leading tool for analyzing vast amounts of information. It leverages these capabilities to identify the most critical risks, establishing filters that effectively sort, rank, and extract risk signals from diverse data sources. This sophisticated approach empowers PSPs to:

Effectively Monitor and Analyze Consumer Reviews of Extensive Portfolios

Using Owlin, Payment Service Providers can continuously monitor and analyze consumer reviews for all their merchants, ensuring comprehensive oversight. PSPs can choose their preferred frequency of updates via a daily check-in or instant alerts when negative trends are identified for a specific merchant.

Analyze Consumer Reviews in Multiple Languages

Owlin’s advanced algorithms enable PSPs to analyze consumer reviews in 17+ languages, ensuring a comprehensive understanding of consumer sentiment and feedback. PSPs can effectively monitor consumer reviews in English, Spanish, Portuguese, Chinese, Russian, French, Dutch, German, Polish, Italian, Danish, Swedish, Arabic, Turkish, Japanese, and Korean. This capability provides PSPs with near real-time insights across diverse linguistic landscapes, facilitating a globally inclusive monitoring approach.

Gain Insights from Easily Interpretable Graphs Depicting Historical Review Trends

Understanding the significance of a single negative review in isolation can be challenging. However, Owlin provides customers with a customizable dashboard that facilitates straightforward interpretation and analysis, as well as the ability to set risk tolerance levels with respect to which type of news or events they wish to be notified of. Our Consumer Reviews module equips PSPs with informative graphs that depict historical review trends, providing a clearer picture. By observing sudden shifts in trends, PSPs can detect anomalies or potential issues associated with a merchant, allowing for timely intervention.

Enhancing Regulatory Compliance through Advanced Consumer Review Monitoring

Owlin’s Consumer Review Monitoring module is part of Owlin’s KYC for PSPs offering. This end-to-end KYC solution offers PSPs streamlined onboarding, continuous monitoring, audit trails and effortless offboarding, not only enhancing KYC frameworks for regulatory requirements but also facilitating future reviews or investigations.

During the onboarding process, Owlin for KYC conducts thorough screenings against multiple databases (figure 3). Owlin’s continuous monitoring capabilities give PSPs real-time insights into entities and help to easily prioritize entities and topics/risks that require immediate attention. When it comes to offboarding, Owlin for KYC simplifies this process and ensures that all relevant case information is retained.

Figure 3

Want To Know What Owlin Can Do For You?

Are you a Payment Service Provider grappling with the challenges of monitoring consumer reviews in multiple languages and identifying crucial trends and risk signals? Look no further as Owlin introduces its cuttingedge Consumer Review Monitoring feature tailored specifically for PSPs.

With Owlin’s advanced capabilities, you can seamlessly and continuously monitor the performance of your merchants, ensuring that potential issues are detected and addressed before they escalate. Take advantage of this opportunity to experience the power of Owlin’s Review Monitoring for PSPs firsthand. Schedule a demo via sales@owlin.com today and discover the transformative impact it can have on your operations.

Sources

1. Leeds-live.co.uk, 2021 Leeds firlm Power Direct accused of ‘rip offs’ as hundreds complain about handing over cash for nothing.