Download Our Whitepaper: Consumer Reviews as a Leading Indicator for Merchant Risk

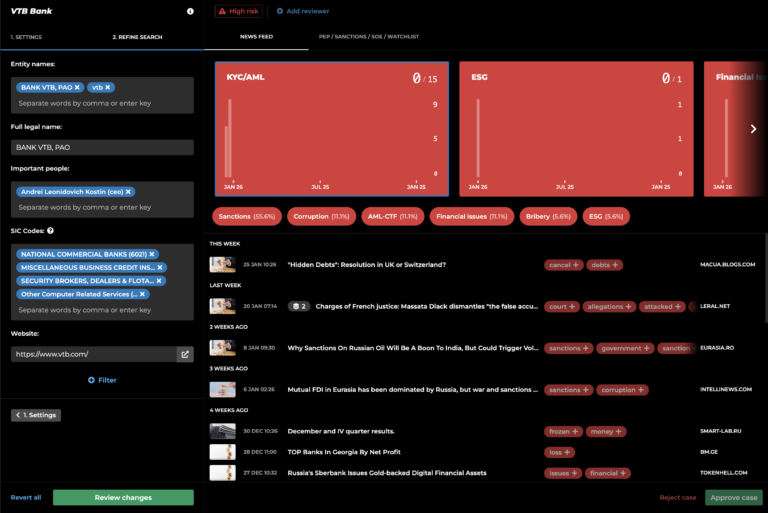

Owlin for KYC

Owlin for KYC offers financial organizations a single solution for onboarding, monitoring, and offboarding that:

- provides thorough screening against multiple databases during the onboarding process;

- continuously monitors all entities and helps to prioritize entities and topics/risks that warrant attention;

- simplifies the offboarding process and retains all case information (e.g. provides an end-to-end audit trail of the onboarding and monitoring workflow).

Are you ready to save time, allowing your KYC Specialists to focus on the signals that matter?

Why do financial organizations leverage Owlin for KYC?

A single solution for onboarding

Owlin for KYC is a single solution that helps analysts automize and combine their Client Identification Program and Customer Due Diligence processes. Analysts will be able to check third parties against all relevant databases at once by setting up personalized queries on the entire Owlin database including:

- Adverse Media Data;

- Chamber of Commerce Data;

- Sanctions Data;

- Politically Exposed Persons (PEP) Data;

- State-Owned Enterprises (SOE) Data;

- Black- and Warning lists;

- Consumer Reviews;

- PDF documents;

- Alternative Data (e.g. financial statements).

Portfolio Transparency

Rank your portfolio dynamically based on different types of risk. Detect emerging risk and sift the signals from the noise. Cover large portfolios and drill-down by various risk factors, including financial, legal or operational risk or ESG-factors.

Continuous monitoring

Most regulators require financial organizations to keep monitoring the subject after they have approved the onboarding case. Owlin for KYC automatically saves queries and alerts KYC specialists about relevant risk signals such as adverse media and changes in individual sanctions & PEP lists.

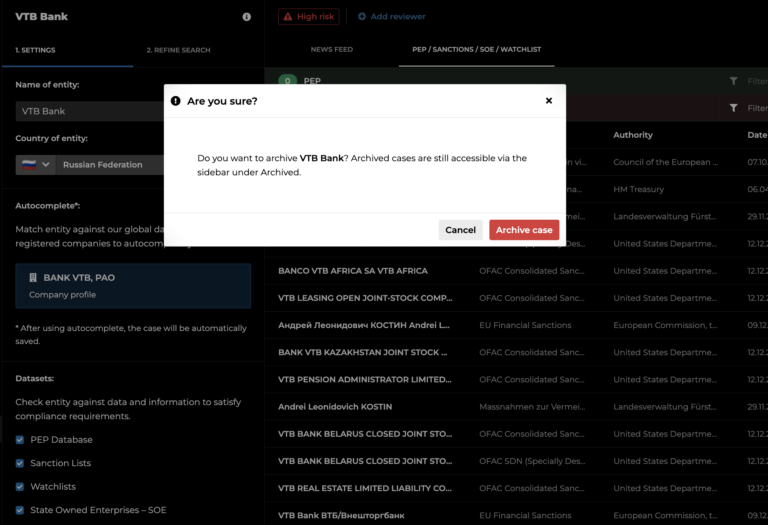

Simplify the offboarding process

Owlin for KYC simplifies case management with intuitive features:

- Close and archive a case from onboarding and monitoring with one click

- Archive all case information (including any internal identifiers linked to the case)

- Export your case’s content and respective comments into a CSV file, or integrate through API to any internal tools.

Frequently asked questions about Owlin for KYC

Why do financial organizations choose Owlin for KYC?

Financial organizations often struggle with fragmented and manual onboarding processes in which merchants are manually identified and screened against risk data sources such as Adverse Media, Sanctions lists, and Political Exposed Persons.

Also, regulators obligate organizations to periodically screen their merchants and provide evidence of the actions taken due to their initial and continuous client monitoring.

Furthermore, organizations struggle to generate a clear and detailed audit trail of alerts, follow-ups, and resolutions during onboarding and monitoring, while regulators are increasingly requiring this.

How does Owlin monitor adverse media?

Our algorithms monitor more than 3 million mainstream and niche sources in 17 languages in near real-time. Leveraging AI (NLP), we present relevant signals in graphs and alerts that help you focus on what’s important. Check out our blog ‘Adverse Media Check: Why a Google Search Isn’t Enough’ for more information about Owlin’s Adverse Media capabilities.

Can we conduct single adverse media searches?

Yes, you can search the entire Owlin database of news articles via an easy-to-use query builder that helps you focus on relevant news (across languages and geographies) within your topic of focus. Moreover, Owlin for KYC gives you direct access to Infobel data that helps complete the query with company info.

What data does Owlin use for KYC for PEP/Sanction checks?

Owlin for Onboarding automatically checks your searches for PEP/Sanction hits which are continuously updated.

Can I enrich the Owlin database with my data?

Sure! Within Owlin for KYC, you’ll be able to enrich the data via PDF integration to come to a one-stop shop of essential intelligence.

Can I work together with my team in the Owlin for KYC environment?

Within Owlin for KYC, you can annotate and share onboarding cases with others. Also, your user-created queries can be saved and accessed by/assigned to co-workers.

Can we set up personalized alerts for adverse media monitoring?

Yes! With Owlin for KYC, you can configure and receive scheduled and instant risk alerts through email.

Does Owlin for KYC generate audit trails?

Yes, it does. Owlin for KYC allows you to generate audit trails of each onboarding case quickly.

Want to see Owlin in action?

Learn more about our solutions and see how we can help your business.

We look forward to meeting you.