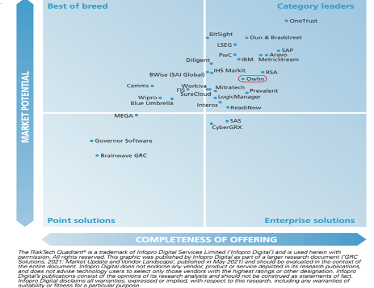

Owlin Mentioned as a Market Disruptor in Financial Crime & Compliance Report Chartis

We’re proud to share that Chartis Research has recognized Owlin as a Market Disruptor in the 2025 Financial Crime & Compliance ranking. Additionally, we have been awarded the Portfolio...